Recognizing the Different Types of Mortgage Available for First-Time Homebuyers and Their Special Benefits

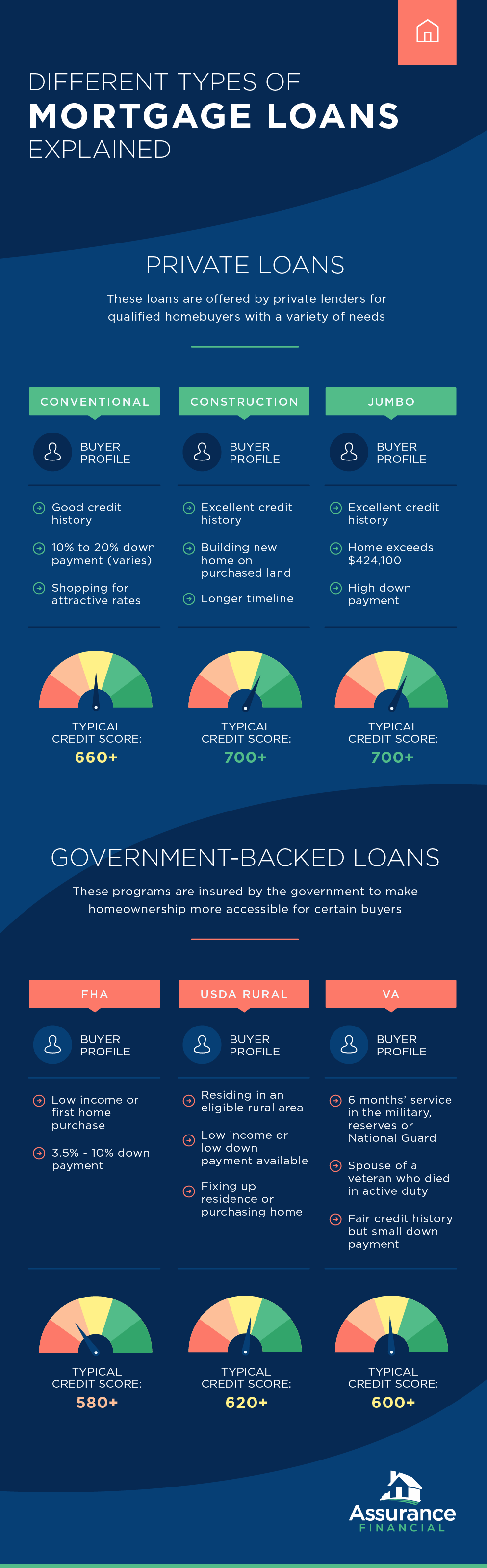

Navigating the variety of mortgage financing options readily available to novice property buyers is essential for making enlightened financial decisions. Each type of finance, from standard to FHA, VA, and USDA, presents one-of-a-kind advantages customized to diverse purchaser demands and situations.

Standard Finances

Traditional loans are a cornerstone of home mortgage financing for new property buyers, providing a trusted choice for those wanting to acquire a home. These finances are not guaranteed or guaranteed by the federal government, which identifies them from government-backed car loans. Usually, conventional financings need a greater credit history and an extra considerable down repayment, often ranging from 3% to 20% of the acquisition rate, relying on the lending institution's demands.

One of the substantial advantages of traditional lendings is their versatility. Debtors can choose from numerous funding terms-- most generally 15 or 30 years-- allowing them to align their home loan with their monetary goals. Furthermore, standard financings may offer lower rates of interest compared to FHA or VA car loans, particularly for debtors with solid credit scores profiles.

Another benefit is the absence of ahead of time home mortgage insurance costs, which are usual with federal government loans. Exclusive home mortgage insurance policy (PMI) might be called for if the down settlement is much less than 20%, but it can be removed once the borrower achieves 20% equity in the home. In general, conventional finances offer a viable and attractive funding alternative for newbie buyers looking for to browse the home mortgage landscape.

FHA Fundings

For several first-time buyers, FHA lendings stand for an accessible path to homeownership. Guaranteed by the Federal Housing Administration, these lendings provide adaptable certification criteria, making them excellent for those with minimal credit report or lower revenue levels. Among the standout functions of FHA loans is their low down settlement demand, which can be as reduced as 3.5% of the purchase cost. This dramatically decreases the economic barrier to entrance for lots of aspiring house owners.

Additionally, FHA financings permit greater debt-to-income proportions compared to traditional lendings, suiting customers who might have existing monetary obligations. The rate of interest related to FHA lendings are often competitive, additional enhancing price. Customers additionally take advantage of the capability to consist of certain closing expenses in the lending, which can reduce the upfront monetary burden.

Nonetheless, it is essential to keep in mind that FHA loans need home mortgage insurance premiums, which can boost month-to-month payments. In spite of this, the general benefits of FHA finances, including ease of access and lower preliminary expenses, make them a compelling option for newbie property buyers looking for to go into the property market. Understanding these car loans is necessary in making informed choices about home funding.

VA Loans

VA lendings use a special financing solution for qualified professionals, active-duty service participants, and specific members of the National Guard and Gets. These fundings, backed by the U.S - Conventional mortgage loans. Department of Veterans Matters, offer several benefits that make home possession much more accessible for those that have offered the nation

Among the most significant advantages of VA lendings is the lack of a deposit requirement, permitting qualified consumers to finance 100% of their home's acquisition cost. This feature is especially beneficial for first-time property buyers who might have a hard time to image source conserve for a considerable down payment. In addition, VA fundings usually come with affordable rate of interest, which can bring about lower month-to-month repayments over the life of the loan.

An additional noteworthy benefit is the lack of personal mortgage insurance policy (PMI), which is commonly required on standard lendings with reduced deposits. This exclusion can cause substantial cost savings, making homeownership extra cost effective. VA financings offer flexible debt requirements, allowing consumers with reduced credit report ratings to qualify more quickly.

USDA Finances

Exploring financing choices, newbie buyers might locate USDA lendings to be a compelling option, particularly for those wanting to buy property in suv or country locations. The USA Division of Farming (USDA) offers these lendings to promote homeownership in assigned rural regions, providing a superb possibility for qualified customers.

Among the standout features of USDA finances is that they need no down settlement, making it less complicated for new customers to get in the real estate market. In addition, these fundings commonly have affordable rate of interest, which can result in lower monthly payments contrasted to traditional funding choices.

USDA car loans also feature versatile credit demands, enabling those with less-than-perfect credit to certify. The program's income limitations ensure that help is directed in the direction of low to moderate-income family members, further sustaining homeownership goals in rural areas.

Moreover, USDA lendings are backed by the federal government, which reduces the threat for lending institutions and can improve the authorization process for borrowers (Conventional mortgage loans). As an outcome, click novice property buyers thinking about a USDA funding might find it to be a helpful and accessible alternative for attaining their homeownership dreams

Special Programs for First-Time Purchasers

Several first-time homebuyers can take advantage of unique programs made to assist them in navigating the complexities of buying their very first home. These programs often provide monetary rewards, education and learning, and sources customized to the unique needs of newbie purchasers.

In Addition, the HomeReady and Home Feasible programs by Fannie Mae and Freddie Mac deal with reduced to moderate-income customers, supplying flexible home mortgage options with reduced mortgage insurance prices.

Educational workshops organized by different organizations can also help novice buyers understand the home-buying process, boosting their opportunities of success. These programs not only minimize financial burdens but additionally empower customers with expertise, eventually facilitating a smoother shift into homeownership. By checking out these special programs, new property buyers can discover beneficial resources that make the desire for owning a home extra attainable.

Final Thought

Conventional finances are a keystone of mortgage financing for first-time homebuyers, offering a reputable choice for those looking to buy a home. check here These finances are not guaranteed or ensured by the federal government, which differentiates them from government-backed financings. Additionally, standard finances might supply reduced passion prices contrasted to FHA or VA finances, particularly for debtors with solid credit accounts.

In addition, FHA financings allow for greater debt-to-income proportions contrasted to standard loans, accommodating borrowers who may have existing financial obligations. In addition, VA lendings commonly come with competitive interest rates, which can lead to decrease monthly settlements over the life of the loan.